To illustrate the difference, consider a company showing a gross profit of $1 million. At first glance, the profit figure may appear impressive, but if the gross margin for the company is only 1%, then a mere 2% increase in production costs is sufficient to make the company lose money. You are comparing profit with sales revenue after subtracting the direct costs of production of the product and taking any sales returns into account to arrive at gross profit in dollars. To calculate gross profit, you need to look at the income statement, also called the profit and loss (P&L) statement, for your business. The second line item may represent sales returns, if you sell a returnable product. After noting COGS, you have the information you need to calculate gross profit.

Gross profit gives you a basic idea of how much your business makes, while gross margin digs a little deeper. Your gross margin will tell you how well your company is generating revenue compared to your production costs for both products and services. The higher your percentage margin, the more effective your company is at managing the generation of revenue for each dollar you spend. It also makes it easier for you to compare your business to competitors, whether local or international. You can then track and benchmark your gross margin against other companies over a longer period to pick up on trends within your specific industry. Also called net profit margin (and often referred to as the bottom line), it’s a measure of how much profit is generated by a company’s sales.

How do I calculate a 20% profit margin?

When you look at your gross profit, consider that it is calculated after all direct costs have been subtracted, but indirect costs have not been subtracted. Indirect costs include the office and administrative overhead for your business. You can run a trend analysis—one type of financial analysis—to determine how your gross profit and gross margin compare with your business’s numbers for previous years.

- Gross margin, also known as gross profit margin, is a financial ratio that measures the profitability of a company’s core operations.

- Another report by Deloitte found that gross margin is particularly important for retailers.

- This ratio offers crucial insights that foster informed decision-making processes.

- These, along with gross margin and gross profit, can give you a truer sense of how a company is performing in terms of the money it’s making and the money it’s spending.

- It is wise to compare the margins of companies within the same industry and over multiple periods to get a sense of any trends.

For instance, in a recession, customers may cut back spending, forcing businesses to lower prices or offer discounts, impacting the overall gross profit margin. Gross profit margin can be subject to considerable variation across different industries due to industry-specific costs and the unique economic reality of each industry. In essence, it offers a way to compare the operational efficiency and effectiveness of companies operating within diverse sectors.

Profit Margin

These metrics are important for investors and analysts because they provide a snapshot of the company’s core operations and profitability. In addition to understanding how to calculate and interpret these metrics, it’s important to consider other factors that affect a company’s financial health. These include but are not limited to operating expenses, taxes, and interest payments. At the very least, a company’s gross profit margin should reach the point where revenues cover production costs. If your GPM fails to achieve this baseline, drastic changes need to be made—and soon.

Start tracking your metrics

But in an effort to make up for its loss in gross margin, XYZ counters by doubling its product price, as a method of bolstering revenue. A negative net profit margin occurs when a company has a loss for the quarter or year. Reasons for losses could be increases in the cost of labor and raw materials, recessionary periods, and the introduction of disruptive technological tools that could affect the company’s bottom line. Growth companies might have a higher profit margin than retail companies, but retailers make up for their lower profit margins with higher sales volumes. A 25% net profit margin indicates that for every dollar generated by Apple in sales, the company kept $0.25 as profit.

What Factors Can Impact a Business’ Gross Profit and Gross Margin?

Gross profit margin is a significant metric of your business’s health and efficiency, yet it doesn’t paint a comprehensive financial picture. Interpreting a company’s gross margin as either “good” or “bad” depends substantially on the industry in which the company operates. Suppose we’re tasked with calculating the gross margin of three companies operating in the same industry. That’s good news if you run a business because you want to keep cash flowing efficiently so you can scale your company up.

How do you calculate gross profit based on the net profit?

Our website services, content, and products are for informational purposes only. The two terms may have similarities but understanding their differences is what could make a difference to your bottom line. Find industry-standard metric definitions and choose from hundreds of pre-built metrics. Evaluating your competitors’ GPM lets you know how much more or less efficient your business operates.

Both calculations are easy to make if you know a company’s revenue and cost of goods sold. You can even go back to previous years to estimate how gross profit and gross margin are trending over time to see how well a company has performed. And companies nancy gates can use these calculations to pinpoint areas where they may need to reduce expenses or increase production efficiency to become more profitable. With all other things equal, a company has a higher gross margin if it sells its products at a premium.

Leveraging the power of modern accounting software not only streamlines the calculation of profit margins but also offers deeper insights into financial trends and patterns. This takes your total revenue and subtracts all your expenses (direct and indirect) to find what percentage of revenue is actual profit. If gross profit margin is the superhero of the profit margin world, net profit margin is the wise sage. It affects everything from setting prices to determining the future strategy of your business.

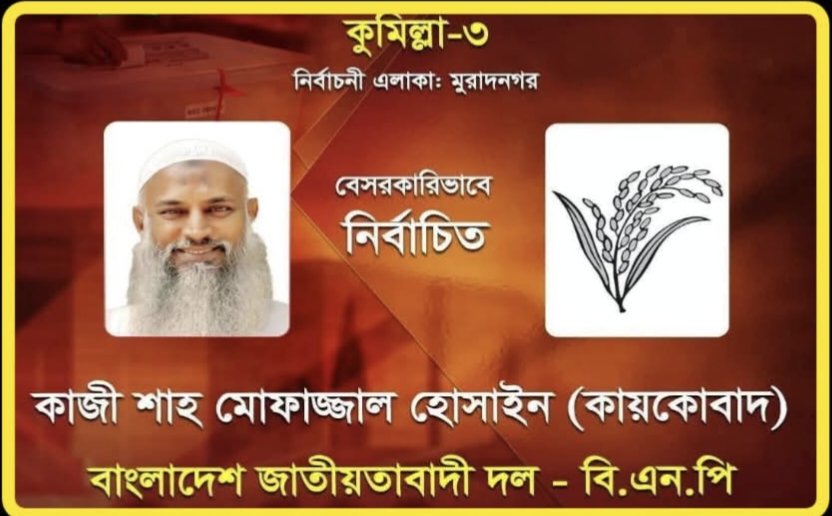

মুরাদনগর বার্তা ডেস্ক :

মুরাদনগর বার্তা ডেস্ক :