The term “accrued”, in the world of savings bonds, is simply another way to say “accumulated.” Your bonds accrue interest from the moment you purchase the bonds. On the last day of each month, your bond’s value will increase by the amount of interest you’re owed for the time you’ve held the bond. Several qualifications need to be made concerning both of these tables.

- A bond’s face or par value will often differ from its market value.

- Interest compounds when interest payments also earn interest.

- Therefore, the 30-year bond has increased 33 basis points over the past month, or 0.33%.

- EE bonds were available in paper form through banks until the end of 2011.

- The term duration measures a bond’s sensitivity or volatility to market interest rate changes.

Given that most fixed income ETFs typically have some type of maturity constraints, it will take time for current portfolio holdings to “roll” out of an ETF, creating space for new, higher-yielding bonds. You may want to avoid callable bonds if you have a very specific, long-term investment plan and you don’t like surprises, but the surprise could be immaterial if the current interest rate has gone up. Perform due diligence in establishing a bond’s credit quality and supply and demand before you jump in. At the very least, you’ll want to consult with an investment advisor you can trust.

Are Bonds Valued the Same As Stocks?

Again, the downside drop is amplified for intermediate bonds relative to its losses when interest rates rise, but the effect is muted in comparison with 30-year bonds. Notice how the 30% gain is larger than the equivalent -22.5% capital loss from the 1% rate rise scenario. Long bonds become more potent at ultra-low and negative rates. That’s what makes them so tempting even in the face of interest rate risk in the other direction.

- Bonds are typically paid in full when they mature, although some may be called and others might default.

- In addition, lower rates mean the discount rate used to calculate the bond’s price decreases.

- Treasury Department guarantees that they will reach face value after 20 years.

- As a result, the only way to increase competitiveness and attract new investors is to reduce the bond’s price.

- When rates go down, new bonds have a lower rate and aren’t as tempting as older bonds.

That helps inform everything from stock selection to deciding when to refinance a mortgage. When interest rates are on the rise, bond prices generally fall. If you’re an investor looking to enter a bond investment via secondary markets, you’ll likely be able to buy a bond at a discount. If you’re holding onto an older bond and its yield is increasing, this means the price has gone down from what you paid for it. However, you’ll still earn the coupon rate from your initial investment. Of course, if a previously distressed issuer regains its financial position or investors decide that it’s likely to meet its payment obligations, then the price of a discount bond may rise.

Premium Investing Services

Duration instead measures a bond’s price sensitivity to a 1% change in interest rates. Longer-term bonds will also have a larger number of future cash flows to discount, and so a change to the discount rate will have a greater impact on the NPV of longer-maturity bonds as well. Market forces (supply and demand) determine equilibrium pricing for long-term bonds, which set long-term interest rates. Given this price forms and associated taxes for independent contractors increase, you can see why bondholders, the investors selling their bonds, benefit from a decrease in prevailing interest rates. These examples also show how a bond’s coupon rate and, consequently, its market price are directly affected by national interest rates. To have a shot at attracting investors, newly issued bonds tend to have coupon rates that match or exceed the current national interest rate.

Prevailing interest rates

Also, callable bonds have a separate calculation for yield to the call day using a different discount rate. Yield to call is calculated quite differently than yield to maturity, as there is uncertainty as to when the repayment of principal and the end to coupons occurs. In any case, higher interest payments have offset declines in bond prices and raised expected total returns over the long term, in the firm’s view.

Treasury Inflation-Protected Securities (TIPS)

Here are the reasons bond prices fluctuate and what you need to know about investing in them. After two years of negative total returns, bonds are back — and investors can thank the Federal Reserve, according to Vanguard. Bond owners are responsible to report the interest earned on their bonds as taxable income by the year they mature, even if the bonds haven’t been cashed.

This happens largely because the bond market is driven by the supply and demand for investment money. Meaning, when there is more demand for bonds, the treasury won’t have to raise yields to attract investors. Bondholders receive monthly payments that are made up of both interest and part of the principal as borrowers pay back their loans.

What Is the Difference Between a Bond’s Coupon and Yield?

Stacy is a nationally recognized financial expert and the President and CEO of Francis Financial Inc., which she founded 15 years ago. She is a Certified Financial Planner® (CFP®) and Certified Divorce Financial Analyst® (CDFA®) who provides advice to women going through transitions, such as divorce, widowhood and sudden wealth. She is also the founder of Savvy Ladies™, a nonprofit that has provided free personal finance education and resources to over 15,000 women. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

The savings bond maturity date is when the government owes you the full amount of principal and interest on your loan. The best protection is to partake in a bond investing program that buy bonds with maturities that are either short (under one year) or short-intermediate (between two and seven years). “Interest rate risk,” also known as “market risk,” refers to the propensity bonds have of fluctuating in price as a result of changes in interest rates. The same company issues Bond A with a coupon of 4%, but this time yields fall. One year later, the company issues another bond, Bond C, with a coupon of 3.5%.

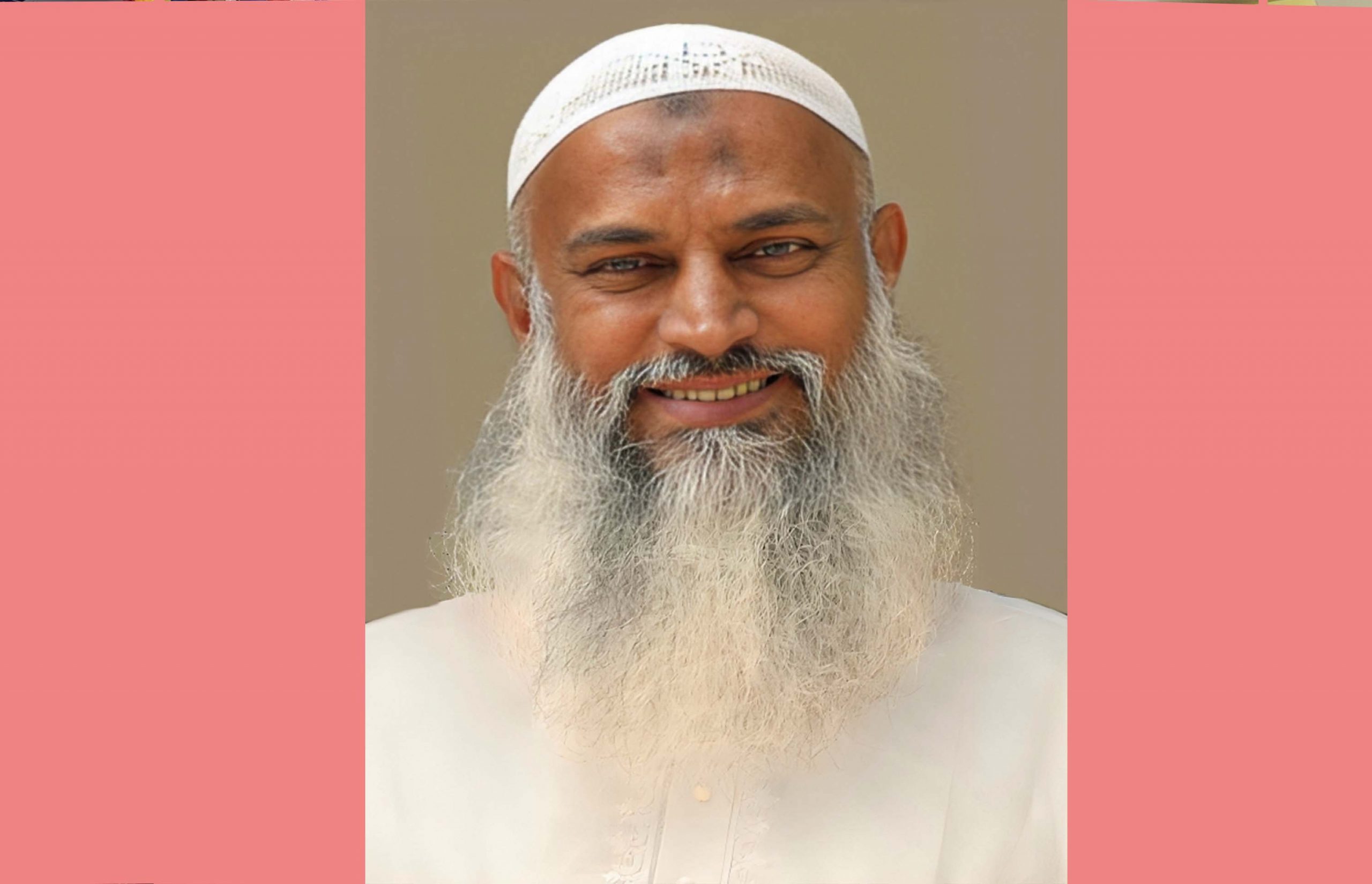

মুরাদনগর বার্তা ডেস্ক :

মুরাদনগর বার্তা ডেস্ক :